Stock Investors aren’t paying attention.

There is an important picture that is currently developing which, if it continues, will impact earnings and ultimately the stock market. Let’s take a look at some interesting economic numbers out this past week.

On Tuesday, we saw the release of the Producer Price Index (PPI) which ROSE 0.4% for the month following a similar rise of 0.4% last month. This surge in prices was NOT surprising given the recent devastation from 3-hurricanes and massive wildfires in California which led to a temporary surge in demand for products and services.

Then on Wednesday, the Consumer Price Index (CPI) was released which showed only a small 0.1% increase falling sharply from the 0.5% increase last month.

This deflationary pressure further showed up on Thursday with a -0.3 decline in Export prices. (Exports make up about 40% of corporate profits)

For all of you that continue to insist this is an “earnings-driven market,” you should pay very close attention to those three data points above.

When companies have higher input costs in their production they have two choices: 1) “pass along” those price increase to their customers; or 2) absorb those costs internally. If a company opts to “pass along” those costs then we should have seen CPI rise more strongly. Since that didn’t happen, it suggests companies are unable to “pass along” those costs which means a reduction in earnings.

The other BIG report released on Wednesday tells you WHY companies have been unable to “pass along” those increased costs. The “retail sales” report came in at just a 0.1% increase for the month. After a large jump in retail sales last month, as was expected following the hurricanes, there should have been some subsequent follow through last month. There simply wasn’t.

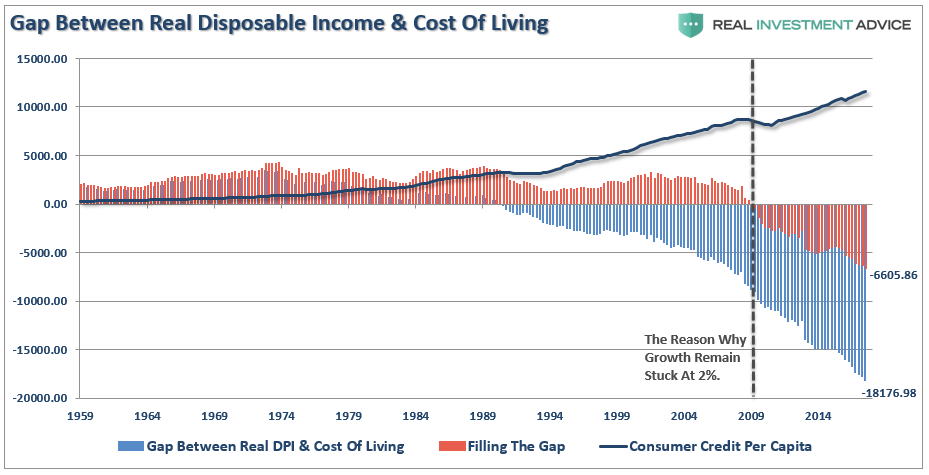

More importantly, despite annual hopes by the National Retail Federation of surging holiday spending which is consistently over-estimated, the recent surge in consumer debt without a subsequent increase in consumer spending shows the financial distress faced by a vast majority of consumers. The first chart below shows a record gap between the standard cost of living and the debt required to finance that cost of living. Prior to 2000, debt was able to support a rising standard of living, which is no longer the case currently.

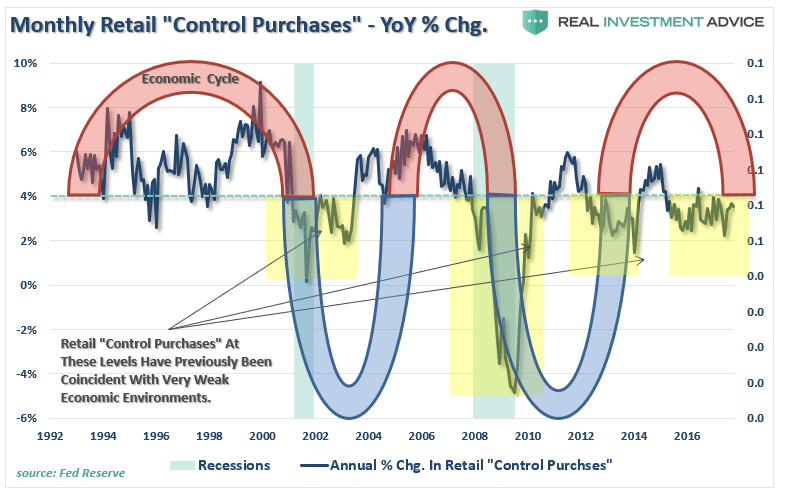

With a current shortfall of $18,176 between the standard of living and real disposable incomes, debt is only able to cover about 2/3rds of the difference with a net shortfall of $6,605. This explains the reason why “control purchases” by individuals (those items individuals buy most often) is running at levels more normally consistent with recessions rather than economic expansions.

If companies are unable to pass along rising production costs to consumers, export prices are falling and consumer demand remains weak, be warned of continued weakness in earnings reports in the months ahead.

As I stated earlier this year, the recovery in earnings this year was solely a function of the recovering energy sector due to higher oil prices. With that tailwind now firmly behind us, the risk to earnings in the year ahead is dangerous to a market basing its current “overvaluation” on the “strong earnings” story.

Don’t say you weren’t warned.